The 2025 proxy season was defined by turbulence and transformation. Activists continued to target companies they viewed as vulnerable, pressing for change both publicly and, more often, behind the scenes. In an uncertain economy, it was easier for them to secure a quick win by pushing for a sale. Only companies with strong boards and the backing of committed long-term shareholders succeeded in resisting these pressures and advancing their own value creation strategies.

Activism and the Rise of Settlements

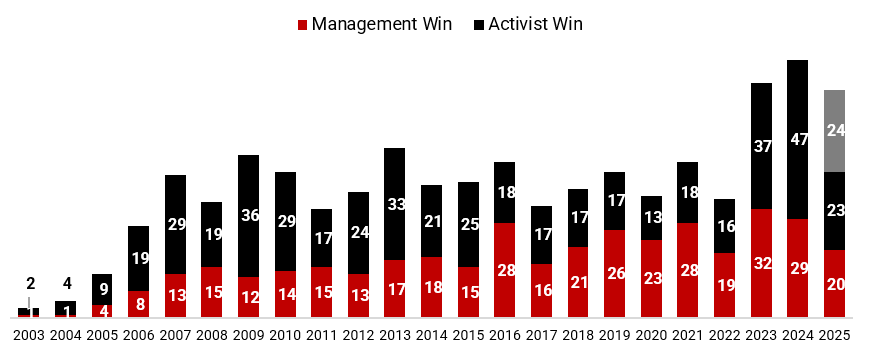

* Management is closing the gap in terms of wins versus activists, suggesting that companies are increasingly better prepared for activist attacks.

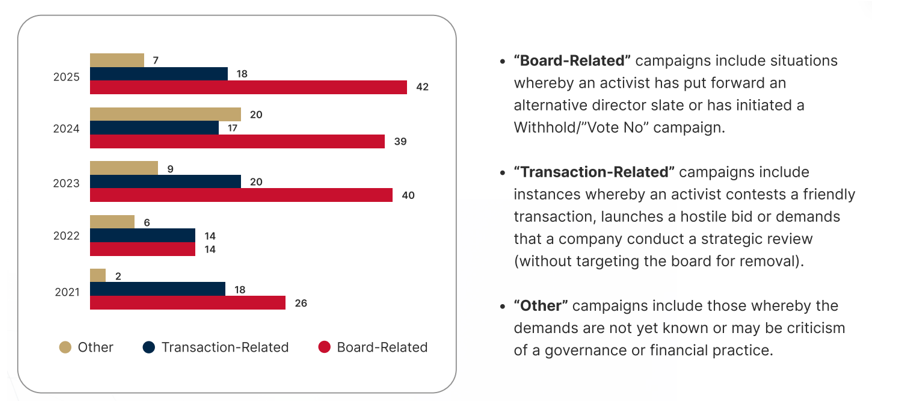

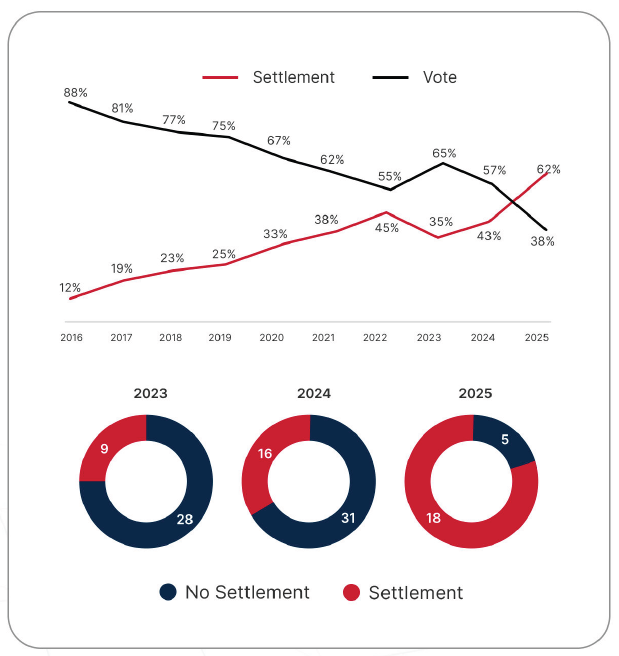

The 2025 proxy season reaffirmed that shareholder activism remains a powerful force—but the tactics are evolving. Kingsdale tracked 67 campaigns in Canada, slightly down from 2024’s record, yet still above the five-year average. What stood out was the shift in how activists are winning: over 75% of victories were achieved through settlements, not votes. This marks a record high and reflects the rise of “one-day campaigns,” where cooperation agreements are reached swiftly and quietly. As shown in the chart below, the last decade has seen a steady increase in settlement-driven outcomes. For boards, this underscores the need to be prepared for rapid, behind-the-scenes negotiations that can reshape governance without ever reaching the ballot.

Board diversity and climate disclosure faced new headwinds, particularly following President Trump’s January 2025 executive order restricting diversity, equity, and inclusion initiatives. This sent immediate shockwaves through the governance world, with some institutional investors rolling back diversity targets and ISS suspending its diversity policy for U.S. boards. In Canada, momentum on mandatory climate and diversity disclosure stalled as regulators paused key initiatives. Diversity and disclosure, once considered settled ground, are now back in play.

Meanwhile, the arrival of artificial intelligence (“AI”) on the shareholder agenda was unmistakable. From zero proposals in 2024 to 14 this year, AI became a visible feature of the proxy landscape in Canada. While none passed, the fact that investors are filing these resolutions signals growing concern over AI oversight. As adoption accelerates, boards should expect these questions to intensify in 2026.

Proxy advisors ISS and Glass Lewis continue to dominate proxy debates, but policymakers are asking whether that dominance has gone too far. Regulatory scrutiny in the United States is rising, with proposals at both federal and state levels aimed at curbing their influence. What is certain is that companies cannot rely solely on proxy advisors – direct, proactive engagement with shareholders has never been more important, even as it becomes more difficult to secure.

Looking ahead, 2026 will demand agility, foresight, and courage. Corporate governance is evolving at breakneck speed, and the boards that prepare before activists appear will be the ones that thrive.

The Future of Proxy Advice: Regulation and Resistance

Recent years have seen public companies and industry groups raise concerns about the influence and dominance of proxy advisors ISS and Glass Lewis. In 2025, the debate gained momentum as lawmakers introduced various initiatives aimed at increasing regulation of proxy advisory firms. Federal proposals include mandating registration with the SEC, requiring annual disclosures, prohibiting robo-voting, and imposing liability for failures to disclose material information or conflicts of interest.

H.R. 4098, the Stopping Proxy Advisor Racketeering Act, seeks to restrict conflicted conduct by proxy advisory firms and establishes penalties for violations. Under its requirements, proxy advisors would be barred from providing voting advice if they have conflicts of interest, such as offering consulting services to the same companies they provide voting recommendations on.

At the state level, governments in Texas, Missouri, and Florida have also introduced measures aimed at regulating proxy advisory firms, with investigations and lawsuits targeting their ESG and DEI policies. Legal challenges have ensued, with proxy advisors contesting the constitutionality of these laws on free speech grounds.

Proxy advisors have generally resisted sweeping industry reforms, citing free speech concerns and arguing that regulatory efforts often produce unintended consequences, such as increased complexity and cost for corporate issuers. Notably, ISS initiated litigation against the SEC and obtained a favorable judgment, reinforcing the notion that proxy advisory services do not constitute solicitations under the Exchange Act.

Despite ongoing political and legal pressures, ISS and Glass Lewis are expected to maintain significant influence in the near term. However, the landscape is shifting, and companies must be prepared for a future where direct shareholder engagement is paramount.

Evolving Shareholder Expectations: The Rise of AI

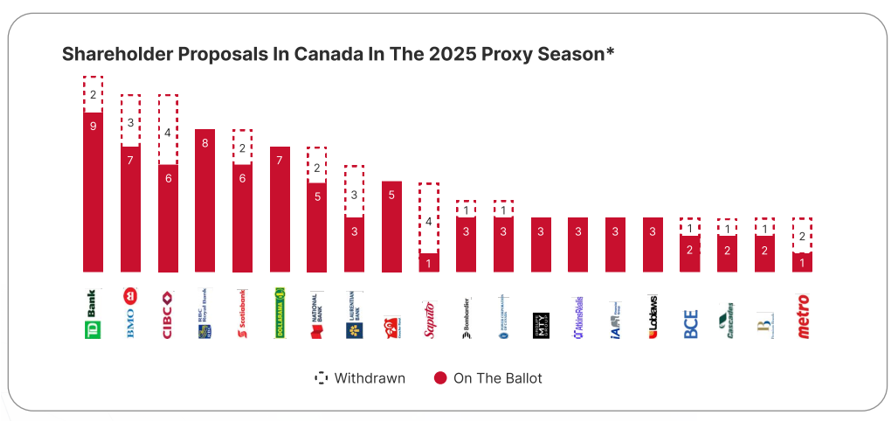

Shareholder proposals in Canada during the 2025 proxy season reflected evolving expectations, with a heavy focus on ESG issues and, increasingly, AI. A total of 88 shareholder proposals were put to a vote, with average support levels declining compared to previous years. Environmental proposals continued to receive modest support, while social and governance proposals saw varied outcomes.

* The displayed issuers received a minimum of three proposals, collectively representing 90.8% of the 121 total shareholder proposals during the 2025 proxy season.

AI emerged as a new frontier in shareholder proposals. Proposals requesting that companies adhere to the Government of Canada’s Voluntary Code of Conduct on the Responsible Development and Management of Advanced AI Systems were submitted to nine Canadian companies in 2025. All nine proposals were opposed by management and received average shareholder support of just 9.1%. Additional proposals requesting adherence to the Code of Conduct were withdrawn prior to voting.

Glass Lewis expects boards to outline their role in overseeing AI, enabling shareholders to gauge how seriously companies approach the issue. While Glass Lewis will not penalize companies solely on gaps in disclosing AI usage and governance, it may recommend against specific directors if poor AI oversight causes material harm.

The Changing Landscape of Shareholder Engagement

Shareholder engagement has become a defining feature of corporate governance. Direct and proactive dialogue is central to maintaining credibility and investor confidence. Yet, securing meaningful engagement has never been harder. Investor bases are more fragmented, expectations more demanding, and access to decision-makers often mediated through advisors or proxy firms.

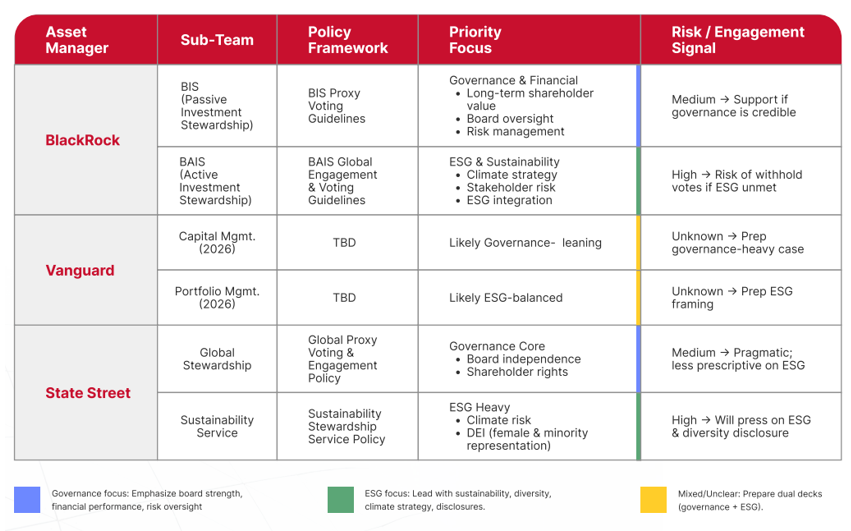

The stewardship approaches of BlackRock, Vanguard, and State Street set the tone for global engagement practices. For issuers, this means a one-size-fits-all engagement strategy no longer works. Tailored approaches are required to meet the distinct expectations of each investor. BlackRock continues to emphasize governance, particularly board strength, financial performance, and risk oversight. Vanguard leans more heavily into sustainability, climate action, and diversity disclosures. State Street takes a blended approach, weighing governance alongside ESG priorities depending on context.

Ultimately, the future of shareholder engagement will be shaped by both access and influence. Companies must be prepared with flexible materials, one set oriented toward governance and performance, another focused on ESG commitments. Success will not be measured by the frequency of contact but by the quality of engagement.

Turning Insight into Action: How Boards Can Lead in the New Proxy Era

As activists, regulators, and investors recalibrated their tactics, boards found themselves navigating a landscape requiring a renewed playbook. While developing Kingsdale Advisors’ 2025 Proxy Season Review, what emerged was more than just interesting statistics. We saw a clear call to action to actively manage the unprecedented volatility and evolving expectations.

What should boards and management teams do to thrive in this new environment?

1. Own Your Narrative, Everywhere

Boards must proactively articulate the rationale behind every director’s skills, experience, and fit for the company’s current challenges. Don’t wait for activists to define your story. Make sure your proxy, IR website, and investor communications consistently reinforce why your board is right for this moment.

2. Prepare for Offseason Activism

Activists are increasingly active outside traditional proxy windows. Assess vulnerabilities now, not later. Develop a “break glass” plan by knowing your weaknesses, aligning your advisors, and being ready to respond with speed and clarity.

3. Engage Directly and Digitally

Don’t rely solely on proxy advisors or traditional channels. Use owned media, digital platforms, and targeted investor outreach to deliver your message unfiltered. Build out your IR website as a news hub to set the agenda before others do.

4. Rethink Engagement in Light of Regulatory Change

With new SEC guidelines and shifting definitions of “passive investor,” engagement strategies must adapt. Separate stewardship teams, clarify policies, and ensure compliance while maintaining meaningful dialogue with shareholders.

5. Address Pay-for-Performance Transparently

Say-on-Pay remains a flashpoint. Review your CD&A disclosure – connect metrics to strategy, explain peer selection, and provide a clear rationale for compensation decisions. Don’t assume shareholders will “get it.” Be ready to own the narrative and preempt misunderstandings.

6. Anticipate the Next Wave: AI and ESG

AI oversight and ESG commitments are no longer fringe topics. Boards should expect more proposals, more scrutiny, and more demand for transparency. Prepare to disclose your approach to AI governance and ESG integration, even if current support levels are low.

In this unpredictable environment, success will be measured not by the frequency of shareholder contact, but by the quality of engagement. Boards that combine strategic foresight with authentic communication will be best positioned to weather volatility and seize new opportunities.

Are you ready to lead in the new proxy era? The time to prepare is now. Contact us at: strategy@kingsdaleadvisors.com